Affordable Car Insurance Quotes

Looking for affordable car insurance you can rely on? Infinity Insurance Agency, Inc. (IIA) can help. With IIA, you can quickly compare car insurance quotes from 20+ trusted carriers at once. We offer budget-friendly and simple personal auto insurance solutions, so you can build a policy that works for you.

To start your auto insurance journey, call a Spanish-bilingual agent at 1-855-478-3705 or get a free car insurance quote online today.

Choose budget-friendly car insurance with IIA

Drivers choose IIA for the following perks:

- Access to discounts and flexible payment plans

- Same-day digital proof-of-insurance cards (once your policy is bound and initial payments received)

- Non-standard insurance options, such as SR-22 insurance

- Multiple quotes from 20+ insurance companies

- Help from Spanish-bilingual agents with your insurance needs, including full coverage insurance

It’s important to remember that “full coverage” is not a single insurance coverage. It’s a common phrase referring to a bundle of coverages a driver may choose.

Coverage made simple

Medical bills, vehicle repairs, and legal fees can add up quickly if you get into an accident. Personal auto insurance can help lessen this financial burden by helping to cover certain costs, depending on your policy.

Personal auto insurance doesn’t have to be complicated. Whether you need the minimum liability coverage mandated in most states or want full coverage insurance, IIA can help you build a personalized policy. With a policy based on your needs, you can:

- Meet your state’s mandated minimums

- Reduce costs after a covered accident or event

- Choose between optional coverages

- Drive with added peace of mind

Personalized auto insurance coverage options

To meet your unique needs, IIA offers a wide range of insurance options. Some of the key types of coverage include:

- Liability coverage: This insurance can cover damage to another vehicle or driver if you're at fault in a covered accident. It’s required in most states.

- Collision coverage: This can help pay for your own vehicle’s repairs or replacement after a covered traffic accident, regardless of who was at fault.

- Comprehensive coverage: This insurance can help pay for covered, non-collision incidents, such as theft, vandalism, or natural disasters.

- Personal injury protection (PIP): This coverage helps pay for medical expenses for you and your passengers after a covered accident, as well as additional expenses like funeral costs or lost wages.

- Medical payments coverage (MedPay): Similar to PIP, MedPay may cover certain medical expenses after an accident.

- Uninsured/underinsured motorist coverage (UM/UIM): This coverage may help pay for your own damages after an accident with an at-fault driver who has little or no insurance.

- Rental reimbursement coverage: If your car is damaged from a covered loss and is under repair, this insurance can help pay for transportation or rental car costs.

- Roadside assistance coverage: Depending on your policy, this can provide towing or emergency services in the event of an accident.

You can build a full coverage auto insurance policy that includes liability, collision, and comprehensive coverage; or opt for the mandated minimums. To get started, call an IIA agent at 1-855-478-3705 or get a quote online.

Why choose IIA for personal auto insurance

As a leading provider of personal and commercial auto insurance options, IIA continues to help drivers find tailored, budget-friendly coverage. Here’s why our customers choose IIA:

- Personalized auto insurance coverage options: We work closely with you to customize your coverage, so you can build a policy that works for you.

- Exceptional customer service: Our experienced agents are committed to helping you navigate the insurance process while providing a high level of service.

- Competitive rates: We work with carriers that offer low-rate options, which can help you save on your auto insurance without compromising on coverage.

- Extensive reach: With IIA, you can compare over 20 different auto insurance carriers, so you don’t have to do more work.

- Bilingual support: Our team includes Spanish-bilingual agents to assist you without language barriers.

- Flexibility: We accept multiple types of licenses, including foreign and matricula consular, to accommodate a wider range of drivers.

Help with non-standard needs: We offer various insurance options for non-standard drivers, including liability-only policies and SR-22 or FR-44 filing services.

Ways to save: Discounts

You may be wondering how to find cheap auto insurance online. IIA helps drivers find auto insurance discounts that may apply to them, including:

1 Paid-in-full discount:

Save on car insurance by paying your premium in full up front.

2 Good student discount:

If you’re a student who maintains good grades, you may qualify for a discount.

3 Proof of prior coverage:

Had a previous auto insurance policy? You may qualify for a discount.

4 Multi-car discount:

If you have multiple vehicles, bundling them in one policy may grant you a discount.

5 Mature drivers discount:

We can connect you with an insurer that may offer special rates for drivers who are 55 or older.

6 Usage-based insurance/telematics:

Using a telematics app (an app that tracks your driving habits offered by some insurers) may qualify you for a discount.

How to get a personal car insurance quote

Getting a quote with IIA is straightforward. We have two convenient options to help you find a personalized car insurance quote:

By phone: Call one of our experienced, Spanish-bilingual agents at 1-855-478-3705.

Online: Get a quote online with just your basic license and vehicle info, and your zip code.

Whichever method you choose, we aim to make the process as easy and efficient as possible, helping you understand the coverage options available to you.

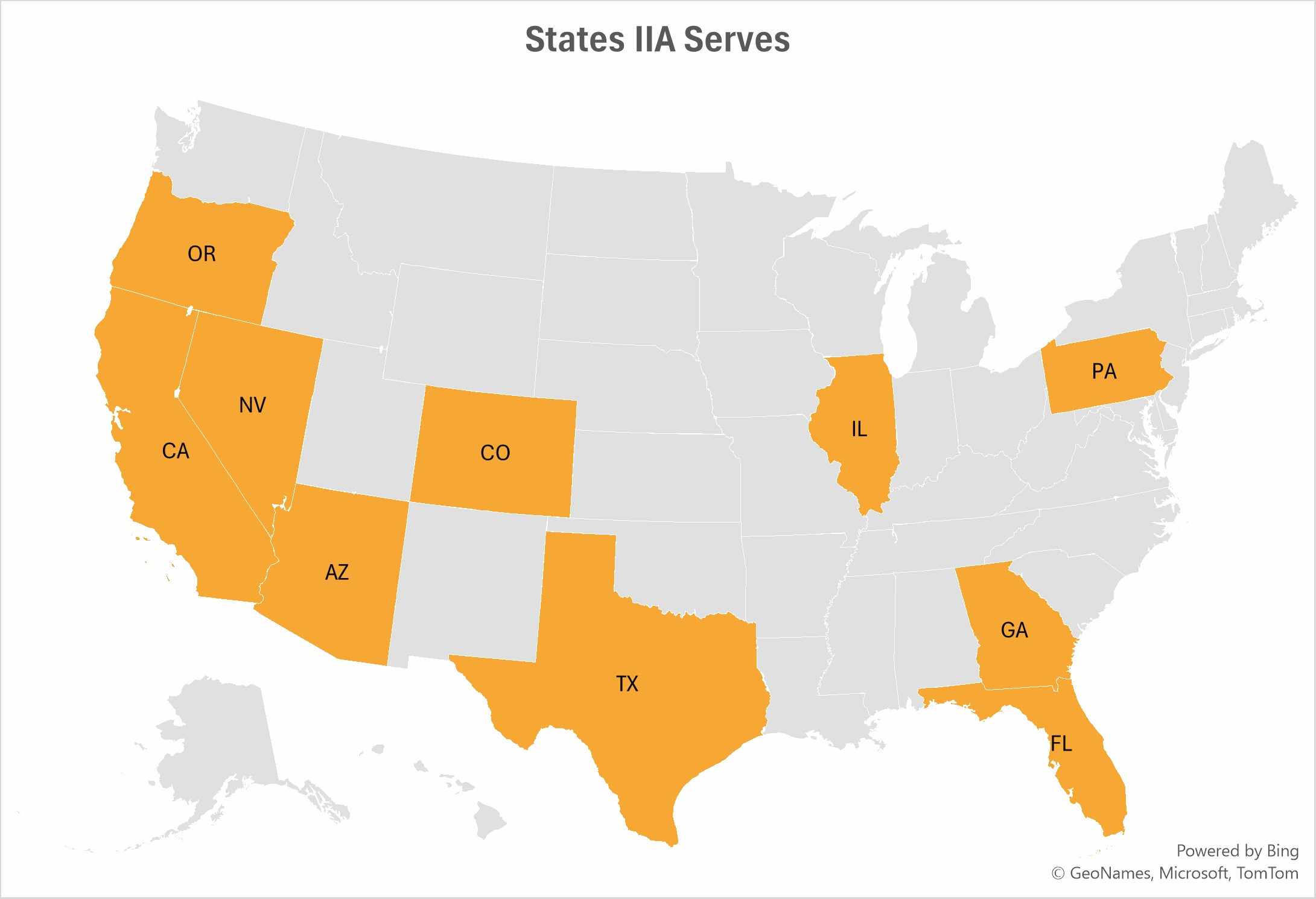

Areas we serve

IIA helps drivers across the country find simple car insurance solutions. The states IIA serves include:

To find out if we serve your area, check out the map below:

FAQs (Frequently Asked Questions)

What are the auto coverage requirements in my state?

Each state has different minimum coverage requirements. If you have questions about what coverage you need, our agents can help you understand your state’s laws.

Can I add my teenager to my policy?

Yes, you can add your teenager to an existing policy. One of our experienced agents can guide you through the process to get the coverage you need.

How much will my insurance cost?

Several factors influence personal auto insurance premiums. These can include your age, driving history, credit score, vehicle type, and the types of coverage you choose.

What does a personal auto insurance policy not cover?

Depending on your policy, your personal auto insurance may not cover certain damages. Some common exclusions may include wear and tear, repairing customized parts, pet injuries, and certain work-related purposes like rideshare or deliveries. To check what your policy covers, discuss it with an IIA agent.

Does IIA offer other types of insurance?

Yes, we offer additional types of coverage, including commercial auto coverage for small businesses. We also offer workers’ compensation, general liability insurance, and inland marine insurance options. You can find out more about the coverage options available by calling IIA or navigating our website.

What payment options and plans are available?

We work with insurance companies that accept cash or credit card payments as well as online payments. Payment plans at IIA are typically monthly or paid in full.

What do I need to get a personal car insurance quote?

To receive a quote, you may need your personal info, such as your license information, vehicle details, and driving history.

Get a free auto insurance quote with IIA

Ready to find a low-cost car insurance option? IIA is ready to help. With us, you can benefit from:

- Spanish-bilingual support

- Same-day proof of insurance, once policy is set up

- A simple car insurance policy process

- Low down-payment options, depending on the insurance company you choose

Compare car insurance quotes now. Call IIA at 1-855-478-3705 or get a free car insurance quote online.

Terms and Conditions

This material is for general informational purposes only. Products, services, and discounts referenced herein are not available in all states or in all underwriting companies. All statements are subject to the terms, exclusions and conditions of the applicable policy. In all instances, current policy contract language prevails. Coverage is subject to individual policyholders meeting our underwriting qualifications and state availability. Other terms, conditions and exclusions may apply.