You just got your auto insurance bill, and your rates are significantly higher than before. Waves of emotions come over you, panic, annoyance, frustration, anger. Now you have to adjust your budget in order to pay your insurance bill. That’s why it’s important to understand what causes increases, so you can help mitigate costs.

What kind of individual factors impact my insurance rates?

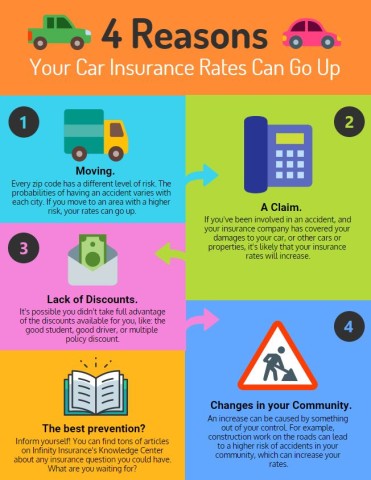

There are a variety of events that can cause car insurance to go up that are entirely dependent on your personal circumstances.

- Filed a claim: Perhaps one of the more common reasons for an insurance increase is when you are deemed at fault for an accident, and you file a claim. Your rates will likely go up in response to this claim because you are now considered a “higher risk” driver due to your previous accident. Your insurance company is responsible for helping pay for damages in a covered accident that you cause. Filing a claim for an accident you are not at fault for can still cause a rate increase depending on the state you live in. Discuss with your agent to figure out what your policy calls for.

- Added a Driver/Car: It’s surprising how much insurance can go up simply by adding another driver. This could be due to that person’s driving history or their lack of history, but even with a crystal-clear history your rate will still increase. Similarly, adding a vehicle to your policy can impact the cost because the greater the number of vehicles, the greater the risk of an accident. The value of the vehicle can also impact your car insurance rates.

- Moving: If you relocate to a new address, whether you are moving across the country or to the other side of town, changing your address can affect your auto insurance rates. This is because different areas have different risk levels such as population density, crime rates, crash statistics, etc.

- Status change: If you qualified for discounts on your now expired auto insurance policy, but the discount no longer applies, your premium may increase. Perhaps you used to have a low mileage discount because you worked remotely, but transitioned to an in-person position that required you to drive to work. You no longer qualify for a discount; therefore, your rate goes up.

What national or societal factors can influence my insurance rates?

Often local, state and national factors can influence your car insurance policy premium such as:

- Pattern changes or increased frequency: If there is an increased number of accidents or break-ins in your area, your insurance rates will likely go up regardless of your involvement in an accident or break-in. Insurance companies call this “increased frequency”.

- Increased severity: Similar to increased frequency, when accidents in your area, state, or even the nation have a significantly increased severity causing repair costs to increase, your insurance costs may also increase.

- Inflation: Insurance companies tend to group inflation with increased severity. When the cost of repairs and parts increases, the cost of insurance follows. This is also true for the cost of used cars. When used car prices increase, customers might receive higher payouts in the event of a totaled vehicle. Auto insurance rates need to account for that increase.

When these issues begin to affect the costs that insurance companies are covering, they submit a request to the state’s department of insurance and the requested increase must be approved before the companies can increase insurance premiums.

How can I mitigate these costs?

The best way to justify the cost of your auto insurance premium is to know exactly what you are covering and why. Most states in the U.S. require liability insurance to drive a vehicle legally, so dropping that insurance policy can have serious ramifications if you’re found at fault for an accident. Paying out of pocket for the total cost of repairs, medical bills, etc. can leave you in financial ruin. It’s wiser to carry auto insurance than not at all.

Speak to an insurance agent to find out what kinds of discounts you might qualify for. This can help you manage some of the increase and receive the best possible auto insurance rate.

Call us today at 1-855-478-3705 to speak to an insurance agent and find out how we can help you save!

Get A Personal Auto Quote Now