Have you ever wondered what to do if you are towed?

Maybe you accidentally parked in a no-parking zone or didn’t see a well-camouflaged fire hydrant, whatever the reason, it’s never fun to realize ‘My car got towed!’. While getting towed may seem stressful, panicking will rarely help the situation. Infinity Insurance Agency, Inc. (IIA) recognizes the frustration associated with a towing experience. Although you may feel a sense of urgency to collect your car, it is suggested that you remain calm and collected.

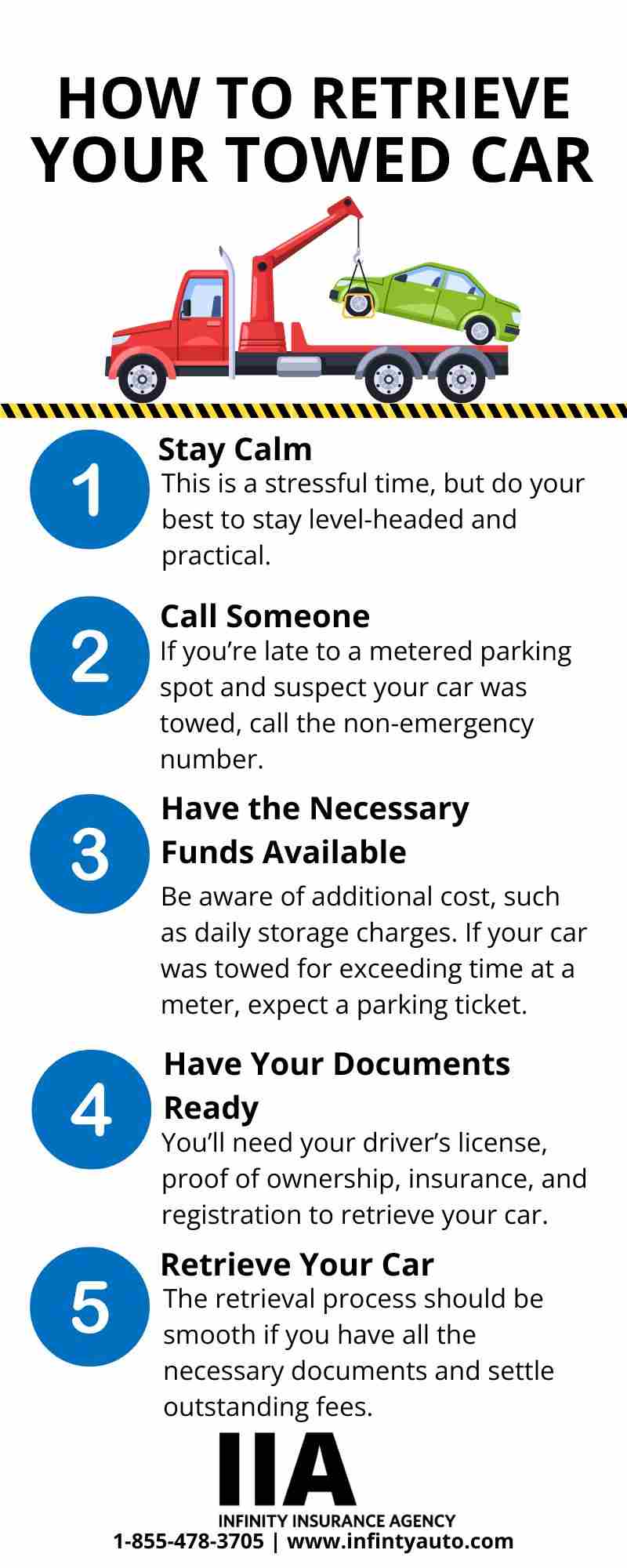

Follow along for practical and actionable steps to handle your towing situation effectively.

How to handle a towed car:

- Stay calm - While you might feel the urge to stress or feel exasperated towards the towing company, try to maintain your composure and address the towing company politely.

- Make a call – Observe available signage if around to determine where your car has been towed and make a call to the appropriate lot to inquire about your impounded vehicle. If there is no signage posted, you can call the police non-emergency line in your city (not 911).

- Have the necessary funds available - Before you retrieve your vehicle, ensure you have sufficient funds to pay the charges via cash, card, check, or mobile payment. Certain impoundment lots may only accept 1-2 forms of payment, (HCFL). Be aware that there could be additional costs on top of the towing charge such as a per-day storage fee, parking tickets/fees, or removal fee for a boot device, (National General).

- Have your documents ready - After securing appropriate funds, be sure to check in with the impoundment lot to find out what documents you will need to present. Typically, you will be asked to show your driver’s license, proof of ownership, proof of insurance, and registration (HCFL).

- Retrieve your car - With your proper documents and payment in hand, you should be able to successfully retrieve your car. Once you settle the outstanding fees, take care to inspect your vehicle before accepting its return, and don’t forget to keep documentation and written receipt of your vehicle's release for your records, (HCFL).

Why was my car towed?

Did you know that parking violations are not the only reason you could be towed? While it is common to be towed for parking in a no-park zone, blocking a driveway, or letting your meter expire, according to National General other reasons for towing can include:

- Your vehicle breaking down or being damaged in an accident

- Impoundment due to unpaid tickets from outstanding traffic violations

- Impoundment due to legal issues

Whatever the reason for your impoundment, try to familiarize yourself with your city's reason for towing to potentially prevent future incidents.

How do you find a towed car?

If you have already determined your vehicle has not been stolen it’s time to locate your towed car. First, look around the surrounding areas and check for towing signs near where your car was parked. Many times, you may spot a ‘customer only parking sign’ that lists the towing company and contact information. If this is the case, make a call to the company to confirm your car’s location and begin your retrieval process. In situations where there are no posted signs, reach out to local law enforcement via their non-emergency line. They should be able to help you determine whether your vehicle has been towed, (HCFL). If you suspect your car was towed by the city, it is possible you can find your car online as in many major cities police departments provide information through a website that lists towed vehicle information, (SanDiego.gov).

How to avoid getting towed in the future

Don’t make the impoundment lot a frequent stop! Try to avoid future tows by taking a moment to review your city’s parking rules and regulations. Many cities may have different rules when it comes to towing. For example, in San Diego, vehicles can be towed for having five or more unpaid parking citations/tickets or parking in the carpool lane, (SanDiego.gov). Save yourself the stress by staying on top of outstanding tickets and car payments.

FAQs

I believe I was towed wrongfully, what should I do?

If you believe your car was wrongfully towed, document the scene as best you can: take photographs of where you parked and any signs in the area and be able to prove where you were while your vehicle was being towed (keep receipts). File a complaint with local law enforcement and the Better Business Bureau. Before you retrieve your car from the impoundment lot, take photographs and inspect the state of the vehicle, including any possible interior and exterior damage caused by the tow truck, (HCFL).

If my car was towed, does it affect my insurance rates?

Depending on why your car was towed and the extent of your outstanding tickets, it is possible that towing could affect your insurance rates.

Do I need insurance to get my car back?

Generally, you will be asked to present proof of insurance to retrieve your car. Ask the towing company what is required and if you don’t have proper insurance, you may need to purchase a personal auto policy before you collect your vehicle, (National General).

No one likes the hassle of an unexpected tow. From potential financial strain to the inconvenience of retrieval, a visit to the impound lot can throw a wrench into your whole day. To minimize these stressful instances, it can be beneficial to thoroughly observe all posted parking signs and review how to handle a towing situation. Understanding the towing process and securing roadside assistance coverage may help facilitate a less stressful and confusing towing process.

Want to add roadside assistance to your auto insurance with Infinity Insurance Agency, Inc? Give us a call at 1-855-478-3705 to receive a free quote today!

Get A Personal Auto Quote Now