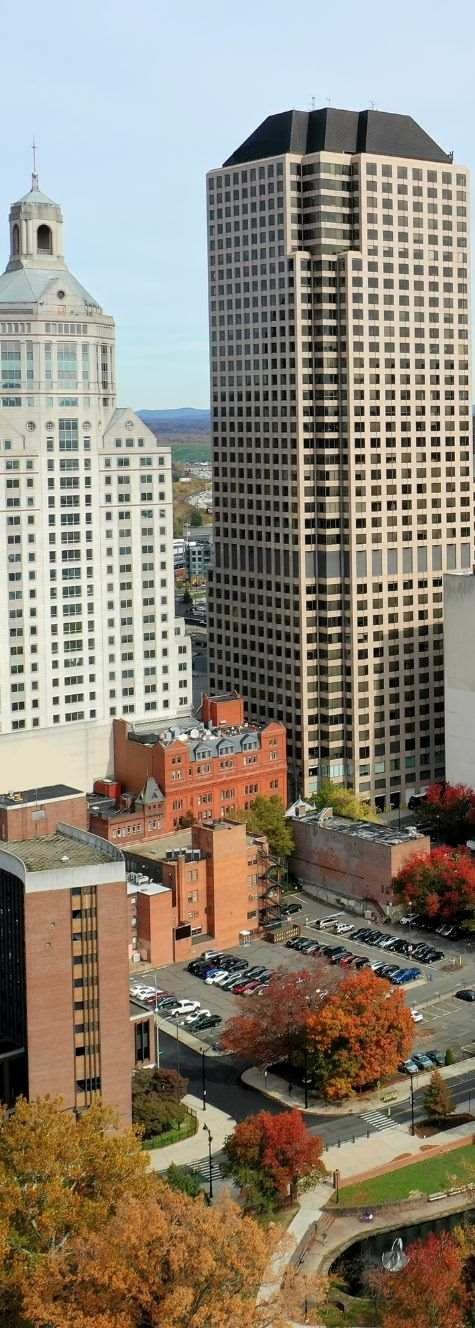

From Hartford to New Haven, the U.S.’s fifth state is awash in stunning foliage in fall, Revolutionary War history, and small businesses. According to the U.S. Small Business Administration Office of Advocacy, Connecticut is home to over 350,000 small businesses that make up 99.3% of Connecticut businesses. These businesses play a crucial role in the state’s economy and range in industry from construction to retail trades. Many of these small businesses may require commercial auto insurance depending on their industry niche.

While you might think you are covered under your personal auto policy, if you use a vehicle to carry out business operations your policy may not extend to covering the financial losses incurred by a covered accident. While activities such as daily deliveries or visits to work sites may seem innocuous, these operations could fall under ‘business activities.’ Vehicles being used for such purposes may require coverage under a commercial auto policy.

IIA can present several commercial auto insurance options to your small business.

Who needs commercial auto insurance in Connecticut?

Curious about whether you will require commercial auto insurance in Connecticut? Commercial car coverage can be a crucial addition for any small business owner. Unlike personal auto insurance, commercial coverage can provide coverage for using a vehicle to conduct business-related activities such as hauling tools, delivering goods, or driving to client’s homes. This specialized policy generally includes higher liability limits and coverage for employees who may drive company vehicles. Commercial auto insurance can lessen the financial fallout if you or one of your employees is engaged in an accident while driving a work vehicle.

By purchasing commercial auto insurance, your business may be more financially prepared for risks associated with business vehicle operations.

Some common businesses in Connecticut that may require commercial auto insurance could include, but are not limited to:

- Construction

- Contracting

- Food trucks

- Catering

- HVAC

- Landscaping/lawn Care

Commercial auto insurance requirements in Connecticut

Like most of the U.S., the state of Connecticut requires all drivers to carry car insurance. According to data from the Insurance Information Institute, Connecticut car insurance requirements include a minimum requirement for bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage.

The Connecticut minimum auto insurance requirements are as follows:

- $25,000 bodily injury liability per person

- $50,000 bodily injury liability per accident

- $25,000 property damage liability per accident

- $25,000 uninsured/underinsured motorist coverage per person

- $50,000 uninsured/underinsured motorist coverage per accident

Many times, these minimum liability requirements will be written as a split limit of 25/50/25. In Connecticut, drivers must carry proof of insurance that can be shown at the request of law enforcement.

How much does commercial auto insurance cost in Connecticut?

Wondering how much commercial car insurance in Connecticut will cost? Several factors may determine your commercial car insurance rate, including:

- The amount of coverage needed - certain types of businesses may require higher coverage amounts.

- Your policy limits and deductibles - usually a higher deductible means you will pay a lower insurance premium.

- Your type of business - certain businesses may be associated with more driving and therefore more risk, which could lead to a higher premium.

- Driving records - the driving histories of both you and your employees could influence your business’s auto insurance premium.

- Number of vehicles - generally speaking, more vehicles will lead to an increased premium.

While commercial car insurance is usually a bit pricier than a personal auto policy, there are many potential discounts at your disposal. IIA is proud to work with insurers that offer the following potential discounts:

- Paid in full - if your business opts to pay its full premium upfront you may receive a significant discount.

- Multiple vehicles - choosing to insure more than one vehicle could potentially score you savings.

- Good driver - a clean driving history may help you receive a discount on your insurance coverage.

- Business experience - if your business has a good track record for a given length of time it could potentially be eligible for a business experience discount.

- Multiple policies - bundling other types of insurance policies (like commercial general liability) with your commercial car insurance could be a way to save.

- Proof of prior insurance - establishing that you have had insurance previously may prove that you are less risky to insure and reduce your premium cost.

IIA coverage options for businesses in Connecticut

Remember that Connecticut minimum insurance requirements are just that, the minimum amounts required by law. Depending on your business, you may choose to explore higher liability coverage as well as coverages such as collision or comprehensive. It is important to keep in mind that liability limits may quickly be used up in instances of serious accidents and/or injuries.

IIA can offer a medley of coverage options in Connecticut including:

- Bodily injury liability coverage

- Property damage liability coverage

- Collision coverage

- Comprehensive coverage

- Uninsured / underinsured motorist coverage

Why Choose Infinity Insurance Agency?

An integral mix of quality coverage, excellent customer service, and competitive pricing makes IIA a go-to provider for commercial car insurance in Connecticut. By working with multiple carriers we can deliver top-notch business insurance solutions, whether you operate a small fleet or fulfill delivery orders with a compact sedan.

With decades of experience, the IIA team can:

Quote competitive rates from many insurers

Offer customized policies from many insurers

Provide multiple options for discounts from many insurers

Give full Bilingual Spanish customer support

Support your business with highly trained agents who are familiar with Connecticut minimum auto insurance requirements

Get commercial auto insurance anywhere in Connecticut with IIA

Whether you are running a food truck out of New Haven or keeping lawns green in Bridgeport, IIA works with carriers that can provide commercial car insurance all over Connecticut state. Business owners in the following cities can utilize our IIA calculator to receive a free estimate today:

- Hartford

- Bridgeport

- New Britain

- New London

- New Haven

- Danbury

- Stamford

At IIA, we’re engaged in the communities that we serve. That's why we've sponsored the annual Hartford Latino Fest.